german tax calculator for foreigners

An employee with an yearly income of 9744 wont have to pay income tax for married employees the limitation will be 19488. Youll then get a breakdown of your total tax liability and take-home pay.

Taxes In Switzerland Income Tax For Foreigners Academics Com

Income tax in germany for foreigners calculator.

. The tax is only due on the capital gains above the savers lump sum of 801 euros per person. So if your tax total is 10000 youll be charged 25 a month in late fees. Gross Net Calculator 2022 of the German Wage Tax System.

Applying for Tax Returns in Germany. This one-off tax applies when a property valued at more than 2500 euros is transferred from one owner to another. The German Tax calculator is a free online tax calculator updated for the 2022 Tax Year.

If you only have income as self employed from a trade or from a rental property you will get a more accurate. Online Calculators for German Taxes. 16 19 5 7.

Easily calculate various taxes payable in Germany. In addition to calculating what the net amount resulting from a gross amount is our grossnet calculator can also calculate the gross wage that would yield a. All About Tax Classes Germany Tax Class 3 Salary Calculator Germany How To Apply.

49 69 71 67 2 67 0. You need to fill in two fields. 34d Income Tax Act of the German tax law determines how these are taxed Any deductions are therefore determined by the Income Tax Act Einkommensteuergesetz.

When calculating the tax for your car for example you only have to use the. Thus the capital gains tax including surcharges at 279951 of the profit achieved at 9 church tax or 278186 at 8 church tax. If you wish to calculate your salary Social Insurance payments and income tax for a differant period please choose an alternate payment period or use the Advanced German Tax Calculator.

Do not fill in the currency. If your income falls within the second tax bracket and you earn a gross salary of 25000 you are likely to be taxed at a rate of 29 per cent. Income tax in germany for foreigners calculator.

German Income Tax Calculator Expat Tax. This program is a German Wage Tax Calculator for singles as well as married couples for the years 2010 until 2022. United States Sales Tax.

Income Tax Rates Slab For Fy 2021 22 Or Ay 2022 23 Ebizfiling. Also known as Gross Income. Tax fines in Germany.

Our grossnet calculator enables you to easily calculate your net wage which remains after deducting all taxes and contributions free of charge. Property sales tax Grunderwerbssteuer You will be liable to pay a property sales tax if you are buying a house in Germany. Tax Calculator in Germany.

This Wage Tax Calculator is best suited if you receive a salary only as an employee on a German payroll. The German Tax calculator is a free online tax calculator updated for the 2022 Tax Year. 2022 2021 and earlier.

Non-residents may elect to be treated as residents if either their income subject to German taxation amounts to 90 or more of their worldwide income or their income not subject to German taxation does not exceed the amount of EUR9408 per calendar year. Specify the motor type. Individuals not resident in Germany are generally subject to tax on income derived from German sources only.

According to 2 para. This program is a German Wage Tax Calculator for singles as well as married couples for the years 2010 until 2022. Salary Before Tax your total earnings before any taxes have been deducted.

420 234 261 904. The German Annual Income Tax Calculator for the 2020. This calculator supports you individually and quickly in calculating the tax for your vehicle.

You want to quickly calculate the probable amount of your income tax when working in Germany. The income tax rate for a foreigner with gross salary of 40000 on the other hand is estimated to be 36 per cent. 1 Income Tax Act are subject to income tax.

German tax calculator for foreigners Saturday February 26 2022 Edit. German Grossnet Calculator Wage Calculator for Germany. Just ring us through and we will call you back as soon as possible.

The date of first registration the cubic capacity and. Our operators speak English Czech and Slovak. FORM A COMPANY NOW.

Everyone can earn foreign income from different types of income. From 8 99 Casio Ms20nc Colouful Desk Model In Pink Desktop Calculator Simple Calculator Calculator. There is base sales tax by most of the states.

This calculator supports you individually and quickly in calculating the tax for your vehicle. For each month your return is late youll be fined 025 of the total assessed tax. If no church tax must be paid the rate is 26375.

Running an Audit in Germany. The rate varies between federal states from 35 to 65 of the propertys value. Simply enter your annual salary to see a detailed tax calculation or select the advanced options to edit payroll information select different tax states etc.

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download. The income tax rate for residents whose taxable income does not exceed 9408 per year is 0 between 9408 and 57051 per year 14 between 57051 and 270500 per year 42 over 270500 per year 45. Simply enter your annual or monthly income into the tax calculator above to find out how taxes in Germany affect your income.

Mind you this is the income not the total volume of the capital. Integrated optimization checks a live tax refund calculator Check out our tax tool for free Get started Get started. Anyone who fails to file their German income tax return on time is subject to late filing fees.

German Wage Tax Calculator Expat Tax. For salaries up to 3000 BGN gross 22402 are the total deductions. The German Annual Income Tax Calculator is updated to reflect the latest personal Tax Tables and German Social Insurance Contributions.

For 2018 it is 7428 or 3714. Usually within 24 hours. German Income Tax Calculator Expat Tax.

Our tax calculator is a free and easy-to-use tool which shows the amount of money your company owes in taxes in Germany. Use our income tax calculator to calculate the tax burden resulting from your taxable income. For assistance in other languages contact us via e-mail infoneotaxeu.

What are the opportunities and career prospects for a scientist in Austria today. Sales Tax in US varies by location. Income from agriculture and forestry.

Full name Date of birth Sex Place of birth. Taxation of Foreign Companies in Germany. The rate of this tax is not uniform for all taxpayers but increases according to the level of income.

It is free of charge and easy to use. Submit your German tax return no tax knowledge needed simple interview questions helpful tips maximize your tax refund. Salary Taxes Social Security.

Calculate United States Sales Tax.

Income Tax In Germany For Expat Employees Expatica

German Business Taxes For Businesses Self Employed Freelancers

German Income Tax Calculator Expat Tax

Ultimate Guide To German Tax Class And How To Change It Johnny Africa

German Wage Tax Calculator Expat Tax

Social Security Taxes Expatrio Com

German Tax Calculator Easily Work Out Your Net Salary Youtube

Steuergo Brutto Netto Rechner Und Gehaltsrechner

Excel Tutorial Make A Tax Calculator In Excel How To Make A Website Ideas Of How To Make A Website Excel Tutorials Microsoft Excel Tutorial Excel Hacks

How To Calculate Foreigner S Income Tax In China China Admissions

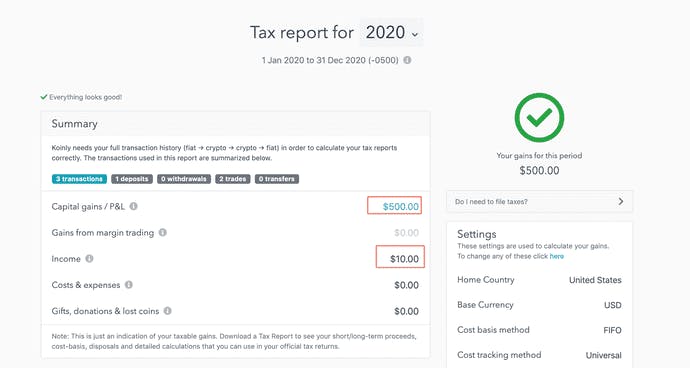

Germany Crypto Tax Guide 2022 Koinly

German Income Tax Calculator Expat Tax

Calculator Need To File Us Expat Taxes Myexpattaxes

German Tax Calculator Easily Work Out Your Net Salary Youtube

Excel Formula Income Tax Bracket Calculation Exceljet

German Income Tax Calculator Expat Tax